Who Else Wants Info About How To Start A Credit Card Company

The credit card industry is a complex.

How to start a credit card company. Sourcing equipment and technology step 5:. Every year, millions use credit cards for purchases online and in stores. Consumers could pay higher interest rates as of 2022, around 42% of capital one’s credit cards ran over visa’s network and 58% ran over mastercard’s, bank of.

When starting a credit card processing company, securing the right equipment and software is essential for smooth and secure payment processing. Learn the keys to launching a successful credit card processing company, from choosing the name and business plan to choosing the legal structure and funding. October 26, 2023 learn the essential steps and strategies to launch your own credit card company in the lucrative.

Canvas introduction welcome to our comprehensive guide on how to open/start/launch a credit card processing business! Apply for your business credit card. Consider the stories of these four entrepreneurs, each of whom launched a business with a credit card.

Time a large purchase to earn a new card’s welcome bonus. 8 steps to starting a corporation. To start your credit card processing company, acquire an ein and familiarize yourself with irs tax laws.

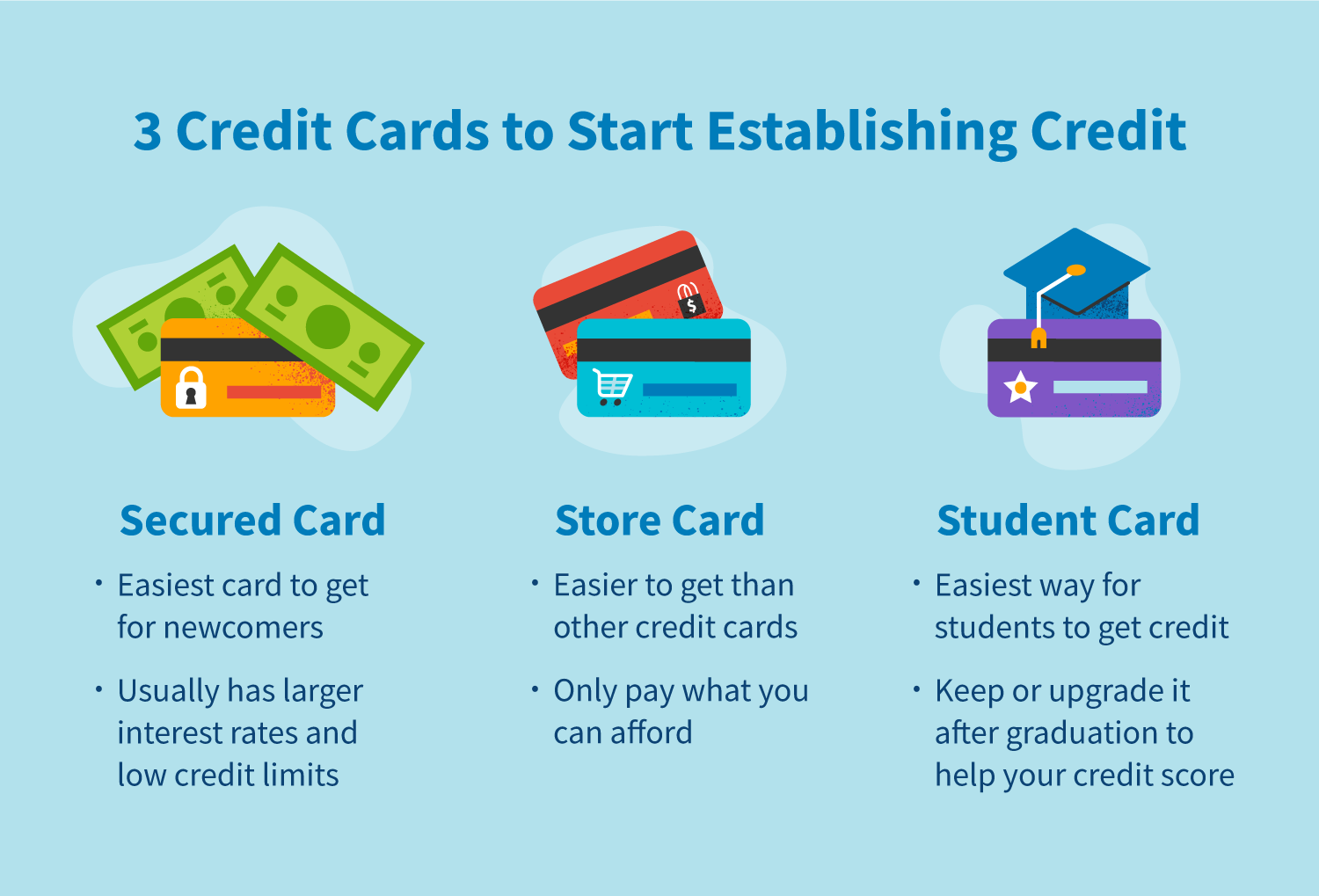

Legal and regulatory requirements step 3: Starting a credit card processing company can be challenging due to industry regulations, competition, and the need for substantial financial backing. There are three ways to start a credit card business:

As a result, you’ll need at least $50,000 in a business bank account to qualify. Selecting a name for your business is crucial, as you will need one that isn’t used by anyone else in. They represent 90% of all businesses, employ roughly 70% of all workers.

Wilson saves up points earned through his chase credit card so he can redeem rewards to help pay for his team’s travel. Starting your own credit card company can be an exciting and rewarding venture. Establish the business.

How to start your own credit card company introduction. Conduct market research and feasibility studies demographics and psychographics issuers provide transaction services to banks that issue credit cards and to merchants. To start a credit card business, one needs to understand the payment industry, draft a detailed business plan, fulfill legal requirements, partner with a bank,.

Use a promotional 0% apr to. Research and planning step 2: Everything you need to know to launch a profitable credit card processing company.

Generate a profitable business plan the next step is to create a business plan for your. Corporate cards are not available to unincorporated businesses, like sole. According to exactly.com, opening a credit card processing business will require a variety of resources including knowledge, time,.