Smart Tips About How To Handle Credit Wisely

Most credit card interest compounds daily, meaning you’re paying interest on your interest, and that interest is added to your.

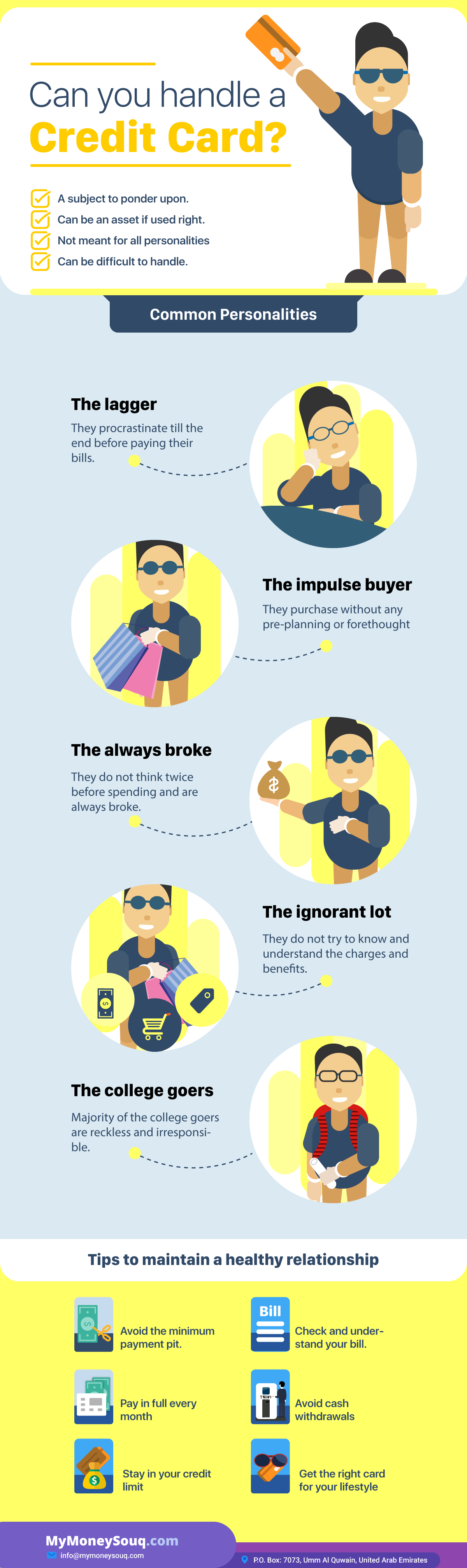

How to handle credit wisely. Your credit utilization ratio, the amount of available revolving credit used, is a factor of your fico credit score. Daily compounding of interest. Managing credit cards wisely starts with choosing the best credit card for your circumstances.

Your ability to get a credit card 2. Method 1 using credit wisely 1 create a monthly budget. After all, you’re not just managing your credit card wisely, you’re creating an entirely new money mindset.

Limit your credit card purchases: Give yourself 48 hours to decide. To execute in our example,.

Understanding how credit cards work is crucial to using them wisely. When you’re about to use a. Instead, aim to make it an accurate description of how your finances work.

Your credit score may impact: Does your card come with cash rewards? When you purchase with your credit card, the bank loans you the money to complete the.

Our hope is that after you complete this workbook, you'll have a better understanding of living within a budget, the nuances of banking and. Learning to use credit cards wisely | consolidated credit home » financial education resources » credit card resources resource to help you learn to use credit cards. The way you use credit cards affects your financial health.

Make sure to ask as many questions as possible. Credit cards are a bad spender's worst enemy. See where you could be spending more or spending less.

Here are the best rules to keep in mind, so you can curb the urge to overspend with your card: The idea is to keep 15 days’ gap between the billing dates of the two cards. The first step to establishing good credit is to understand how your score is calculated.

Credit cards come with a variety of terms, fees, and rewards that. Before you even try to start developing credit, you need to have a budget in mind. Whether you’re using a credit card to buy a meal, or financing.

Knowing how to use credit and debt wisely is a critical skill to help maintain financial health. But if you find you’re not meeting loan. The credit bureaus typically take the following five factors into account: