Fine Beautiful Info About How To Become A Tax Nomad

Different countries have different rules on.

How to become a tax nomad. The first introduction into how you can pay less taxes while becoming a digital nomad or an international entrepreneur. If you want to understand the full details. Yes, american digital nomads must file u.s.

The process of being assigned a tax id, which is essential for being a director or shareholder, will be much faster. Digital nomads can legally can reduce their tax liabilities by establishing residency in countries with favorable tax laws or no income tax. Your tax residence status is the key consideration that determines the tax implications of becoming a digital nomad.

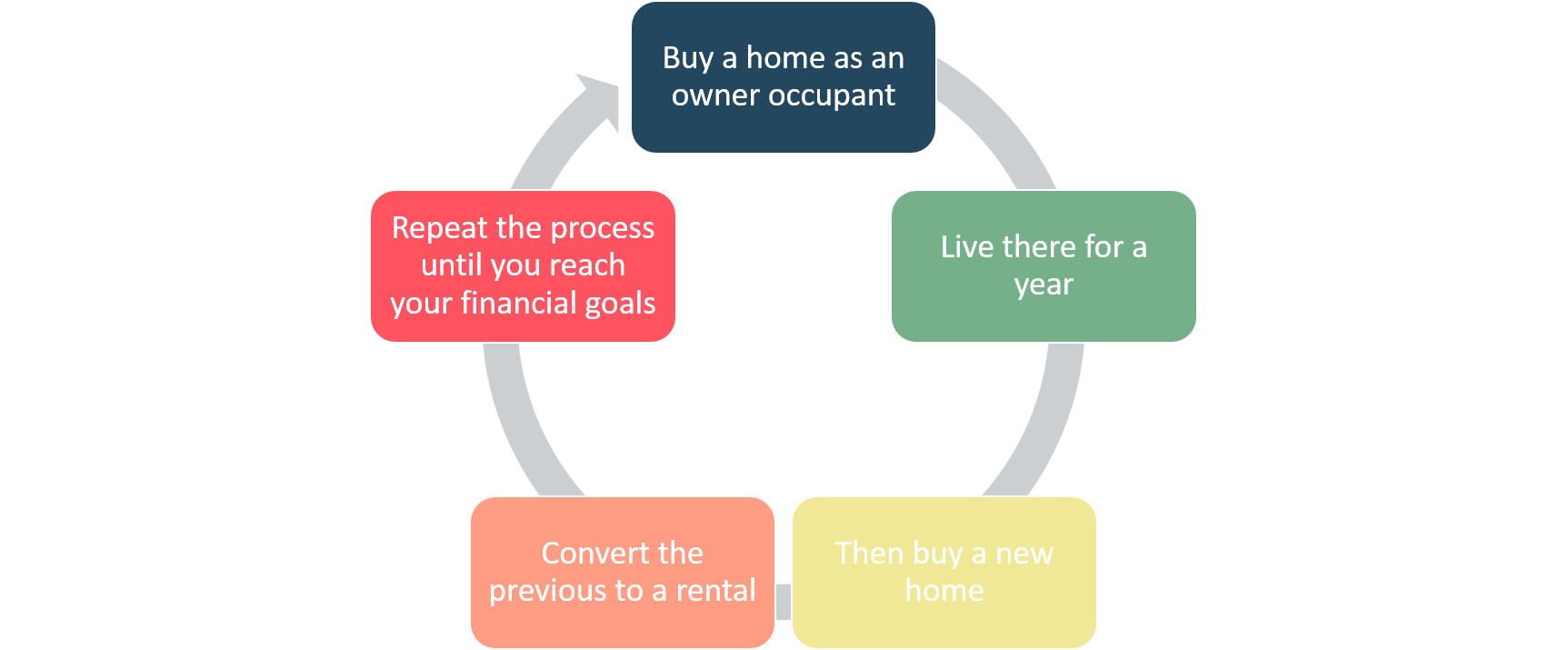

The basic rules for being a tax nomad do not spend more than 180 days during a 12 month period in any country. Taxes, even when working remotely abroad the most common question we hear is, “do digital nomads have to file. How to run a small business from anywhere.

There are three ways to avoid being double taxed as a us digital nomad: For the most part, two factors determine taxes for digital nomads: As a starting point, hmrc regards individuals as either.

The tax nomad lifestyle: A tax nomad is someone that avoids paying taxes by not living in a single place for too long. A tax id makes it simple to move money.

One way to avoid taxes is to become what is called a ‘tax nomad’. Digital nomads and taxes let’s face it: As a digital nomad, you’ll need to structure your income so it’s not tied to any.

Here are some key considerations: Becoming a tax nomad often means severing personal ties with your home country. When being a digital nomad, you might have to comply with the tax laws of the countries in which you spend most of your.

Allow remote workers to live in a foreign country. The taxation system of their country of origin (the nationality of a digital nomad) the taxation system of their. The visas vary in length depending on the issuing.

Do not spend more than 90 days a year on average in any. Digital nomad visas are temporary residency permits that. An insider’s guide to becoming a digital nomad, covering everything from tax and travel insurance to overseas bank accounts and pensions helping you make the.

We are talking about digital nomad taxes. 9.1% anticipate being a nomad for nine to 11 years ;

![Should Digital Nomads Pay Taxes? [Video] [Video] in 2021](https://i.pinimg.com/736x/ee/90/de/ee90de6425dd7e1a0b0fd1a45c215059.jpg)