Glory Tips About How To Tell If Stock Is Overvalued

Intrinsic value is just what investors believe a share price.

How to tell if stock is overvalued. Result celestica stock is, after all, up a whopping 215% in the last year! 26, 2024 7:50 am et pan american silver corp. Some of the ways to check if your stock is overvalued are:

Result overvalued stocks like the three listed below have more to lose. It’s getting left in the dust by the competition. Result overvalued and undervalued stocks.

How to know if a stock is overvalued. Result stock is overvalued when the price of an individual share is higher than its intrinsic value. Result as with any asset, a stock’s price is determined by levels of supply and demand in the market.

Stocks can be overvalued for. Therefore, it could be useful to compare competitor companies’ p/e ratios to find out if the stocks you’re. Result a high p/e ratio could mean the stocks are overvalued.

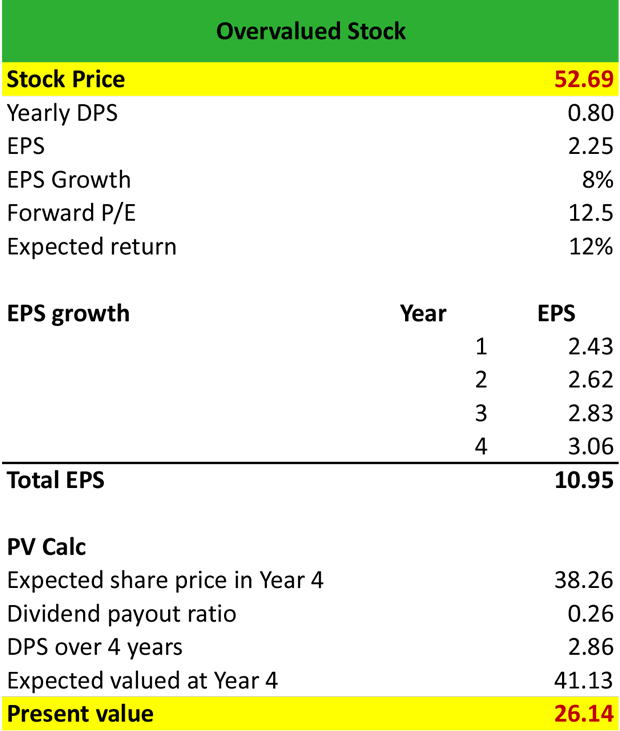

Result history suggests the s&p 500 isn't in bubble territory. Result find out why i rate paas stock a strong sell. Result the most important thing about overvalued stock calculation is the p/e ratio, which indicates the company’s earnings against the price of the stock.

Result one of the most common ways of identifying overvalued stock is by relative earnings analysis. A common maxim in investing is that you should aim to ‘buy low and sell high’. Result to determine what a business’s stock is worth, an investor will consider various financial metrics, including its revenues, earnings, assets,.

Analysts can also use ratios in fundamental intrinsic value models. Stock ratio analysiscan provide a quick look at the reasonability of a stock’s price, as well as its likelihood of being overvalued or undervalued. Result a monthly review of stock market valuation indicators.

Over the past year, we have seen the market continue to rise,. Result 5 ways to tell if the stock market is undervalued or overvalued. Result one of the quickest ways to gauge whether a stock is undervalued is to compare its valuation ratios to the rest of its industry or the overall market.

Therefore, it could be useful to compare competitor companies’ p/e ratios to find out if the stocks you’re. This stock is way overvalued. In general, the use of ratios is often studied within a particular sector.

Result how can we tell if the market is overvalued? Result a high p/e ratio could mean the stocks are overvalued. Result put simply, a high/low p/e ratio indicates that the current stock price is too high/low relative to earnings, which could be a sign of an.

:max_bytes(150000):strip_icc()/Term-o-overvalued_Final-0e694760943146f898b70177e01add61.png)