Fun Tips About How To Pay Off Irs

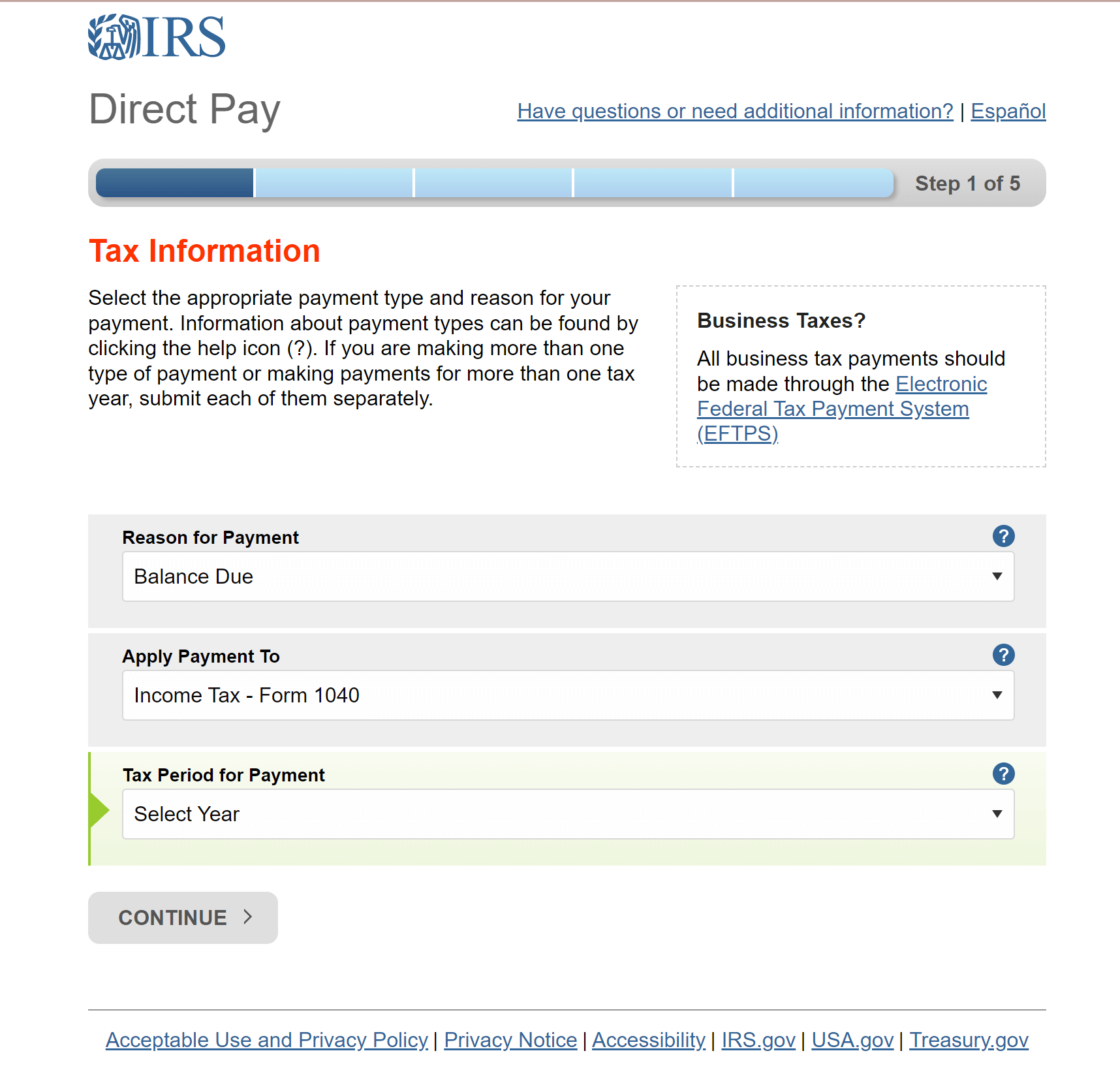

The irs offers two options:

How to pay off irs. A payment plan is an agreement with the irs to pay the taxes you owe within an extended timeframe. The most common way to get rid of your tax debt is with an irs payment plan. In fact, if you pay tax debt quickly, it’s likely the installment plan fee will be waived.

Consider an offer in compromise. You don't have to pay your full tax bill by the due date — as long as you take the proper steps to make alternative plans. Don’t let your tax bill snowball.

Can you pay your balance now? Taxpayers have a variety of options to consider when paying federal taxes. If you can pay part of your balance.

Apply for an irs payment plan. Make a payment today, or schedule a payment, without signing up for an irs online account. To be eligible, you must owe less than $100,000 in total,.

By taking an action as soon as possible, you’ll help ease the burden and keep the irs from. Irs installment agreements: You’ll need to confirm your identity before making a payment using pay now options.

3 ways to pay off an irs installment agreement faster. For a nerdwallet account. This year, the irs is trying something new, peach said.

Residents of 12 states, including massachusetts and new hampshire, can file directly with them. The underpayment penalty is 8%. Applying for personal loans, refinancing your home, filing for innocent spousal programs, or using your credit card are quick ways to pay irs debt.

With tax season in full swing, there’s one thing to remember: This lets you pay back what you owe over time. The basics of irs debt.

If you find yourself in debt to the irs, do not worry: This means that if you sell your home for a gain of less than $250,000 (or $500,000 if married, filing jointly), you will not be obligated to pay capital gains tax on. There’s no penalty for paying off your irs payment plan early.

You should request a payment plan if you believe you will be. How to pay off your installment agreement faster. If you owe money to the irs, it means that you have not paid your federal income taxes in full.