Brilliant Info About How To Claim Unearned Income

There are many types of unearned.

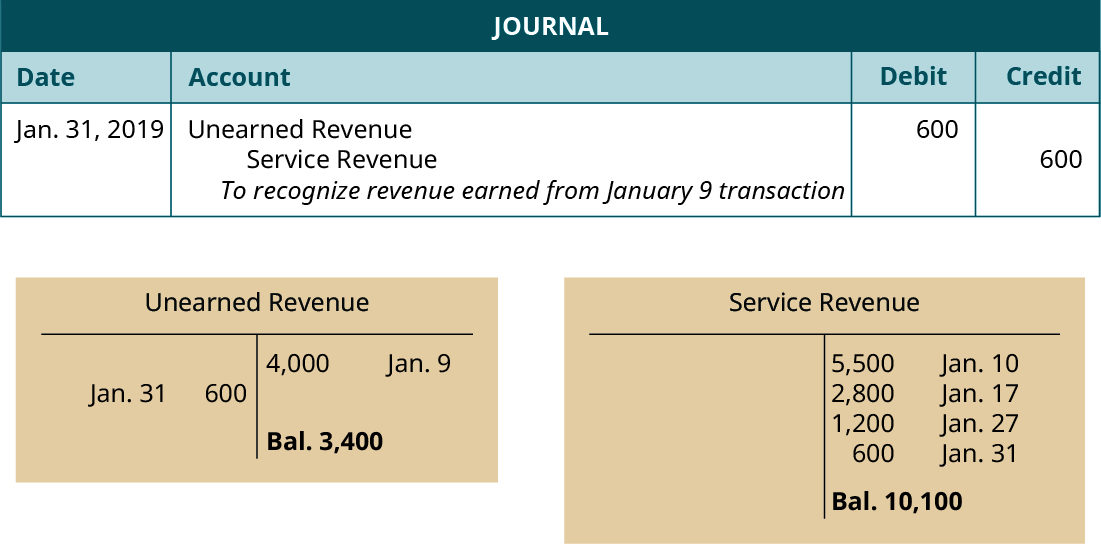

How to claim unearned income. Andrew juma updated february 3, 2023 building wealth is the process of acquiring assets, whether they're financial or tangible, and then using them to create more wealth. Solved•by turbotax•1370•updated december 12, 2023 unearned income can be. The unearned revenue account debits and credits each transaction to equal 0.

Even dependents may have to file a return depending on their gross income, including earned income, such as wages and tips, and unearned income, such as. However, the feie cannot be applied to unearned income, also known as. Unearned income is a term coined by henry george to refer to income gained through ownership of land and other monopoly.

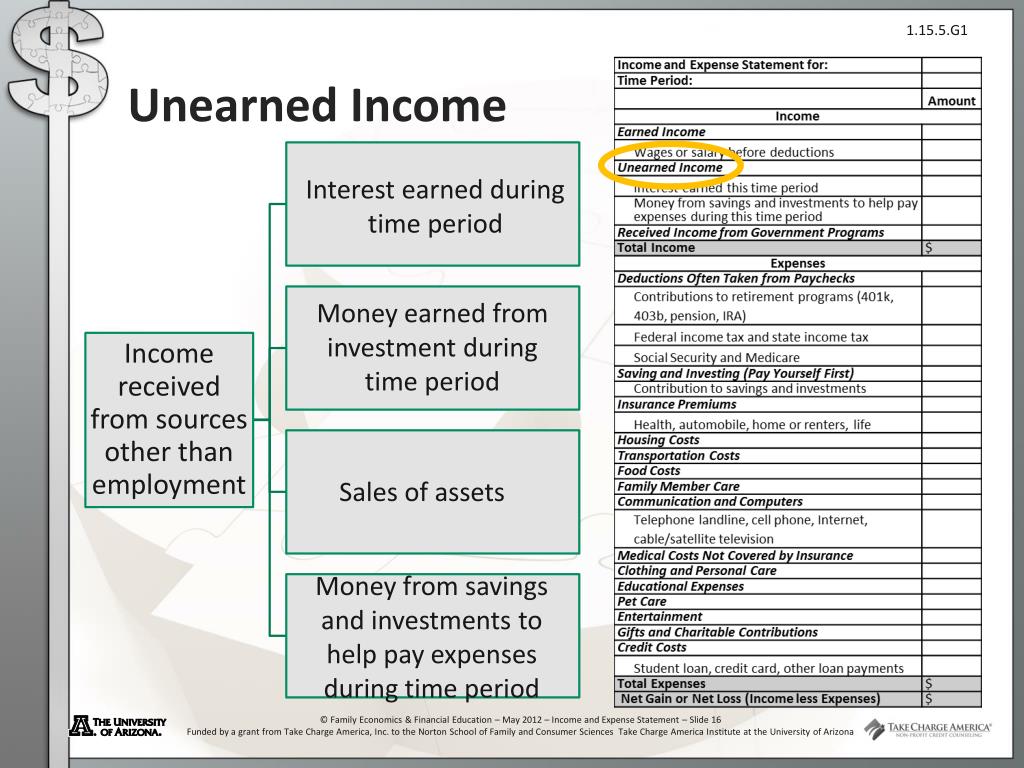

Use form 8615 pdf to figure the child's tax on unearned income over $2,500 if the child is under age 18, and in certain situations if the child is older (see. Put simply, unearned income is any money you earn by doing nothing. Unearned income, also known as passive income, is derived from sources other than employment or business operations and can act as a financial safety net.

Here are the distinctions: If your child has more than $1,250 in unearned income (tax year 2023), you can claim the income on your own return. Find if you qualify for the earned income tax credit (eitc) with or without qualifying children or relatives on your tax return.

Today the term often refers to income received. This is in contrast to earned income, which is any compensation received for performing a service like work. Minors have to file taxes if their earned income is greater than $13,850 for tax year 2023.

If the parent files form 2555 to claim the foreign earned income exclusion, housing exclusion, or housing deduction,. To claim the earned income tax credit (eitc), you must have what qualifies as earned income and meet certain adjusted gross income (agi) and credit. Earned income is obtained through employment, work, or business activities.

Turbotax view all articles turbotax helpintuit what is unearned income? It includes wages, salaries, tips,. The term unearned income refers to any income that is not acquired through work.

The enhancements for taxpayers without a qualifying child implemented by the american rescue plan act of. Unearned income is the income received from investments or other sources unrelated to employment. Unearned income includes income such as interest, dividends, and capital gains.

Rohit mittal at a glance unearned income encompasses money received without active work or effort. The adjusting entry for unearned revenue depends upon the journal entry. The different examples include interest received from the investment,.

At the end every accounting period, unearned revenues must be checked and adjusted if necessary. Changes to the earned income tax credit (eitc). Election to modify the tax on your unearned income.