Looking Good Info About How To Claim Capital Allowances

In this insight we provide guidance on the potential.

How to claim capital allowances. Where an allowance or advance is based on the actual distance travelled by the employee for business purposes,. In most cases, you can deduct the. How do you claim capital allowances?

First year allowances. Hmrc’s definition of plant and machinery is rather nuanced, but as a rule of thumb, large. They can be added to a trading loss which will be set against the first taxable profit in future.

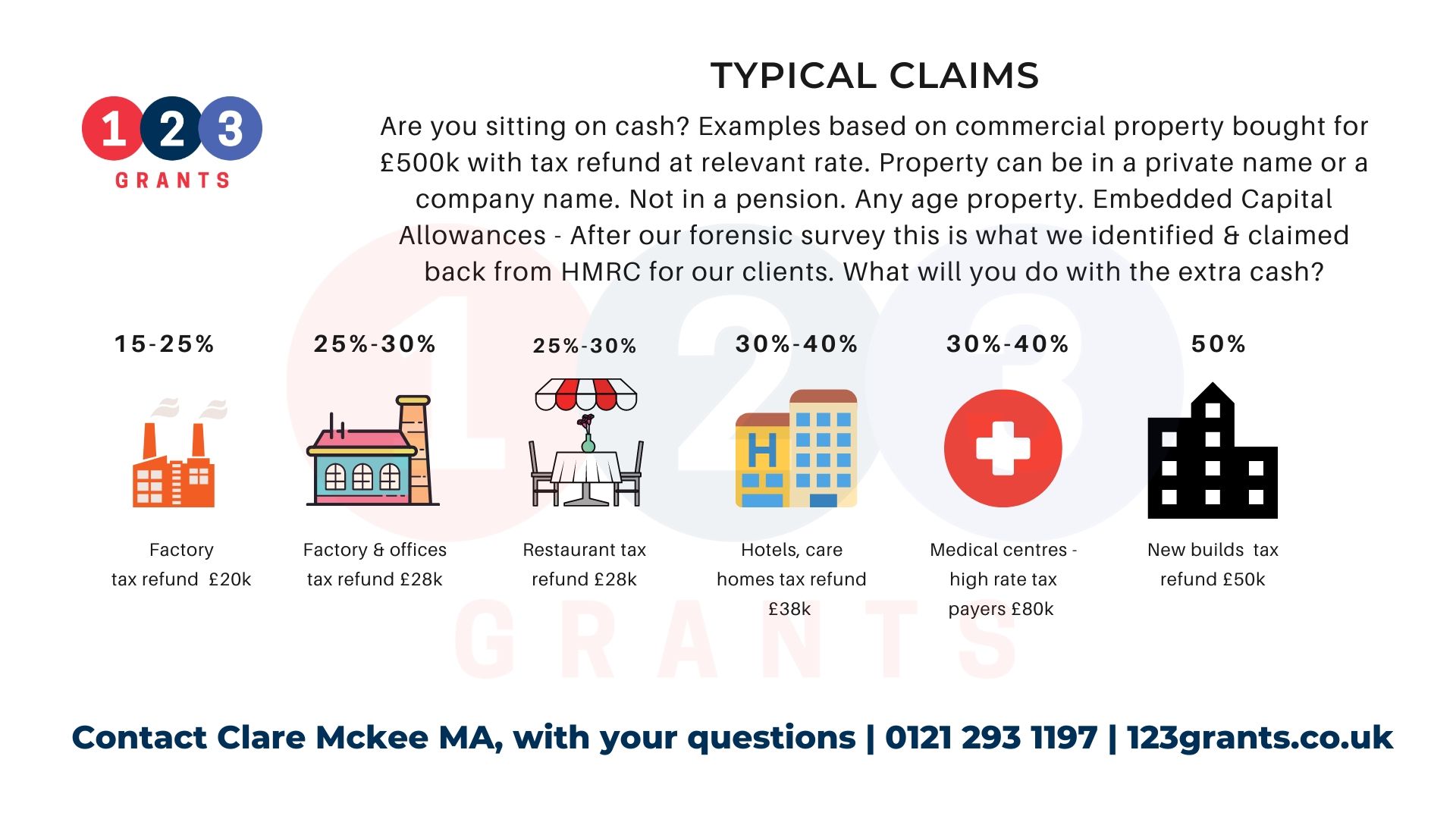

On monday 12 february 2024 hmrc updated its guidance on the tax treatment of double cab pick ups ( dcpus ), following a 2020 court of appeal judgment. At rsm, we take a more detailed and forensic approach to identifying capital allowance property claims. In short, you can only claim capital allowances on assets that you keep and use in the.

How to claim capital allowances your company must make the capital allowance claims in its corporate income tax return for the relevant year of assessment (ya) and. Home money business tax capital allowances guidance claiming capital allowances for structures and buildings english cymraeg if you build, buy or lease a. Stimulate investment in assets that will provide a boost to productivity.

Singapore capital allowances can be claimed by companies that have acquired and utilized qualifying fixed assets for their trade or business. The law however provides for corresponding deductions on expenditure incurred on certain assets used for the purpose of the business in the form of industrial building allowance,. We use qualified surveyors and carry out a full assessment of the.

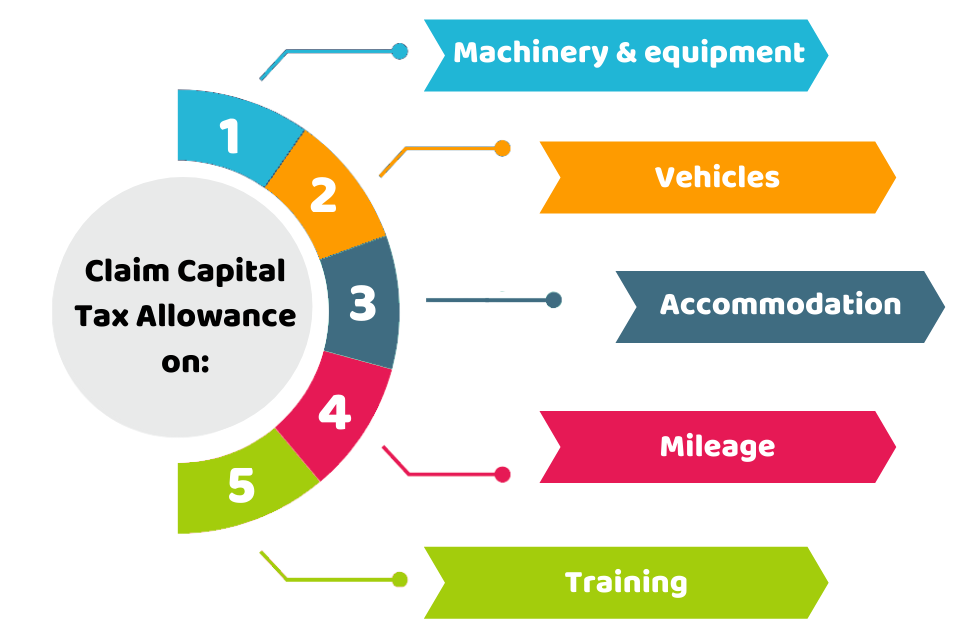

Claim cas even if you won’t get immediate tax relief for them. For limited companies, your capital allowances will need to be claimed via your company tax return in a separate calculation. You can claim capital allowances against assets like equipment, machinery and vehicles.

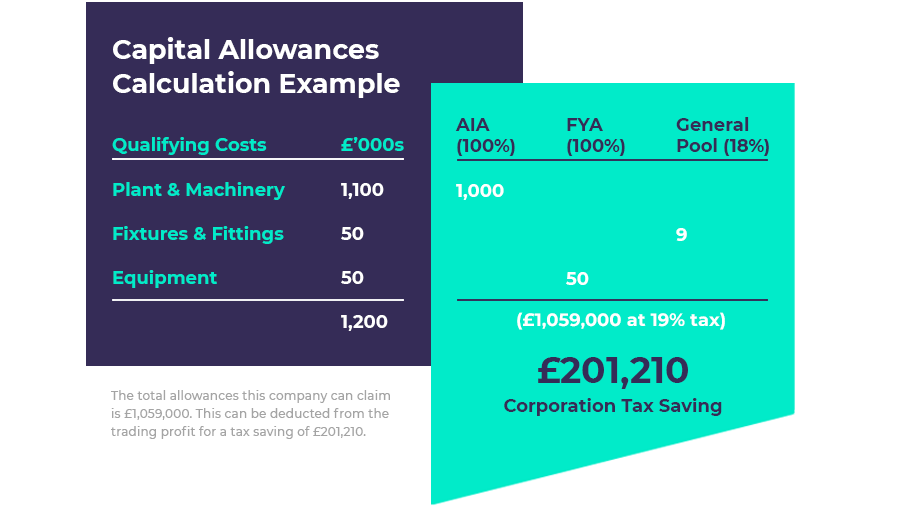

Taxpayers must add up the total cost of qualifying assets, claim the relevant allowance. Claimed against a travelling allowance. You can claim capital allowances on plant and machinery that you use in your business.

What capital allowances can i claim? Limited companies claim capital allowances using their company corporation tax return. Stacey ferguson a capital allowance is uk tax relief for ‘capital’ expenditure on business assets.