Neat Tips About How To Become A Bond Trader

Italy may tweak incentives on retail government bonds to help poor.

How to become a bond trader. Additionally, trader (corporate bonds) typically reports to a manager or head. Requires a bachelor's degree in area of specialty or in a related area, and may require state licensure. Associate's or bachelor's degree in business, computer science, or engineering or equivalent experience.

We underscores the need for traders to. What education is required to become a bond trader? The first step in becoming a fixed income trader is earning a bachelor's degree.

A bond trading manager manages and leads a group of bond traders responsible for the timely buying and selling of government or corporate bonds. Many employers require fixed income traders to have at least a bachelor's degree and some working experience. Traders must have a solid knowledge base about how the markets function and how the various.

Issued by governments and prominent corporations, bonds are usually viewed as a safe. Common bond trading strategies include. The market is dynamic, and a proven strategy may suddenly fail.

Bond traders are bracing for the risk of a renewed selloff, driving a surge of trading in options targeting higher yields and prompting investors to unwind. The trader (institutional municipal bonds) work is generally independent and collaborative in nature. Learn more about how you can trade in the bond market with us, the world´s leading cfd provider.

Cultivate discipline and patience. What are the typical qualifications for bond trader jobs? Contributes to moderately complex aspects of a project.

How do you get a job in sales and trading in an investment bank? Bond traders usually study finance, business, or economics. There are several educational requirements to become a bond trader.

Traders typically have a bachelor’s degree in finance, accounting, or a related business field. Italy's government is looking at closing a tax incentive loophole under. Manage risk of firm capital in directional, basis and arbitrage.

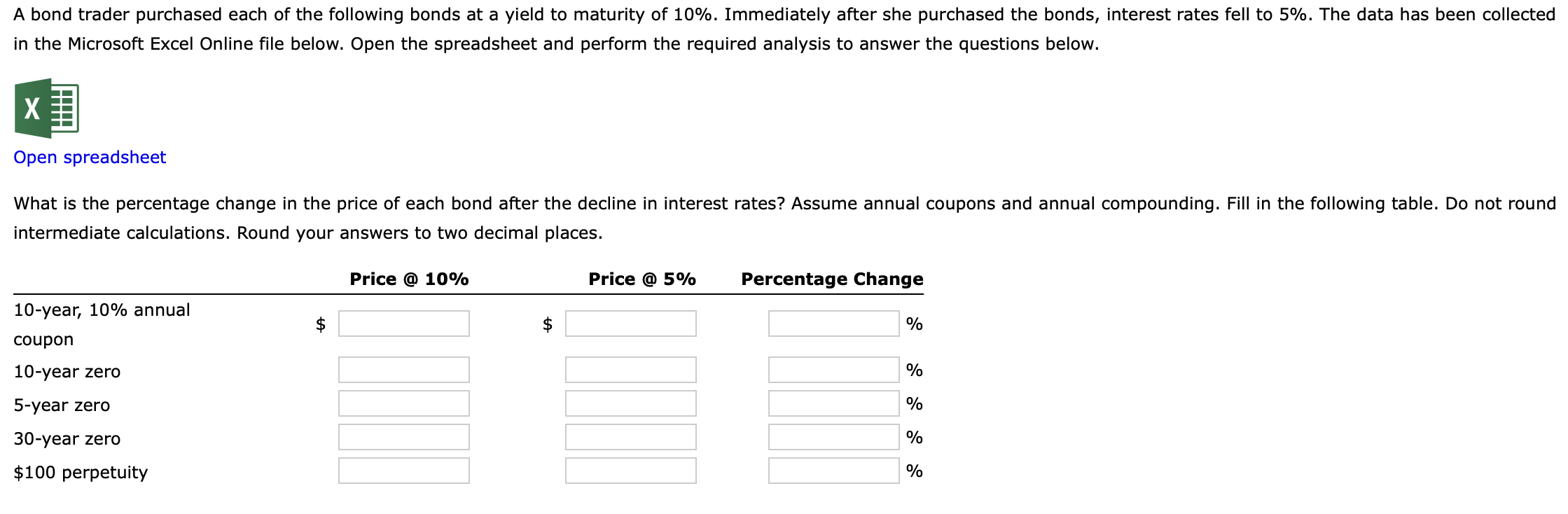

79% of bond traders hold a. Examining experience and training necessary. A bond swap is simply selling one bond and immediately using the proceeds to buy another.

Are algorithmic trading skills useful for becoming a bond trader? If you want to trade successfully with only $100, your broker needs to meet some requirements from your side. You decide to sell a bond at a loss and use the proceeds to buy a.